US dollar rallies on as markets price in Trump election win

- întoarce-te

- Latest

The path of least resistance for the dollar continues to be up, on the back of strong economic numbers and market doubts about the extent and timing of future Federal Reserve rate cuts.

As we get closer to the US election, polls and prediction markets will play an increasingly pivotal role in currency markets, as much as, or even more so, than economic reports and central bank decisions. The only major release this week will be the PMIs of business activity, the most important being that out of the Eurozone, which last month indicated an economy on the verge of contraction Other than that, traders will be following keenly the prediction markets to see if Trump’s recent bounce is sustained. While Trump now appears to hold the upper hand in most of the swing states, his advantage is slim, to say the least. See our full US election preview report, to read more about our thoughts on the vote and its possible impact on markets.

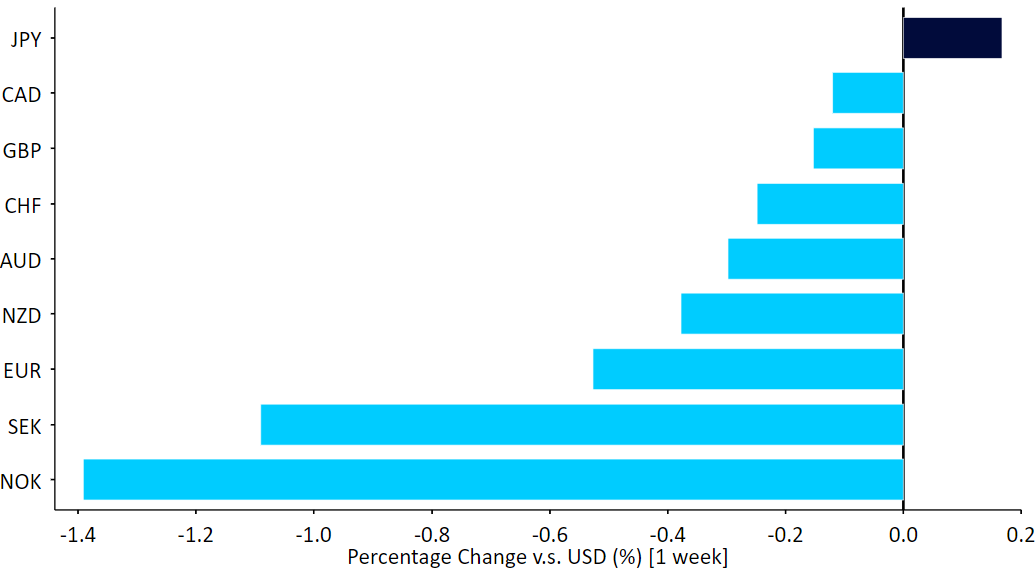

Figure 1: G10 FX Performance Tracker [vs. USD] (1 week)

Source: LSEG Datastream Date: 21/10/2024

USD

The US election trade has now become fully clear, with markets assuming that a Trump victory implies a strong US dollar rally, amid greater protectionism and the prospect of lower US taxes, while a Harris presidency would mean modest losses on lower market and geopolitical uncertainty. Currency moves are now more impacted by the shifting polls than the second-tier data we received last week, although the latter continued to paint a picture of a strong economy that is nowhere near a recession.

This will be the second consecutive week without critical economic reports out of the US, so expect trading to be mostly driven by polls and electoral prediction markets on the one hand, and Federal Reserve communications on the other. We will be looking for continued signs of hawkishness in the latter, with FOMC officials seemingly keen to convey to markets that US rate cuts will take place at a gradual pace from now on.

EUR

The ECB cut interest rates as expected rates last week. The communications accompanying the decision suggests that the institutions’ view on policy has been impacted by dismal economic data out of the Eurozone and signs that inflation is back within target. Lagarde continued to reiterate that future cuts will be data dependent, by markets are not convinced and are see additional rate reductions as all but a certainty at the next few meetings, with a non-zero possibility of a 50 bp cut at some point.

Considering the extent of the move in rate markets, the euro performed rather well, ending the week only slightly down against its peers, in a sign that it may be finding a bottom at current levels. This view will be tested on Thursday by the release of the PMIs of business activity, which are now on the verge of signally economic contraction in the Eurozone as a whole.

GBP

Sterling continues to hit fresh eight-year highs against the euro, on the back of resilient economic data and the progressive dissipation of worries about trade conflicts with the UK’s largest partner, the EU. Last week’s inflation report for September undershot expectations, but employment and wage data for August and September remained quite strong, while the September retail sales number blew out expectations and confirmed the resilience in domestic spending.

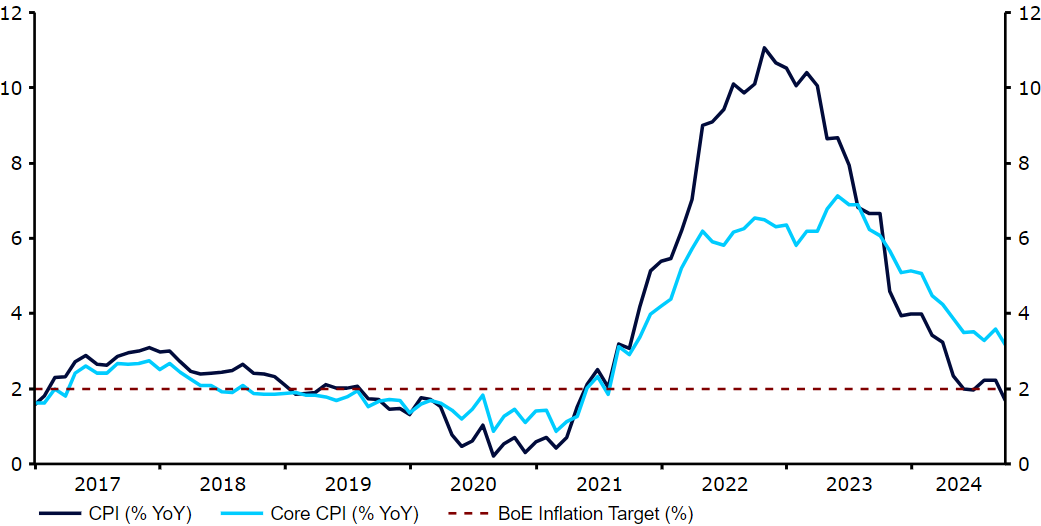

While the bullish case for the pound remains intact, in our view, we see heightened downside risks in the immediate term. Last week’s inflation data has not only all but guaranteed another BoE rate cut in November, but raises the risk of a dovish shift in the bank’s rhetoric. The October budget, the first under the new Labour government, could also trigger some GBP selling action should the pending tax hikes go further than markets are currently expecting.

Figure 2: UK Inflation Rate (2017 – 2024)

Source: LSEG Datastream Date: 21/10/2024

RON

Disappointing readings from the industrial sector were the highlight of last week in Romania. Both output and sales disappointed; the latter particularly so, recording an 11.8% drop over the previous month. The above data brings the Romanian industry closer to the characteristic of not only the CEE region, but almost all of Europe.

It is also worth noting that the current account, one of the most closely watched indicators with regards to Romania, registered a similar contraction in August as in the previous month (2.8 bn EUR). However, it was still wider than a year ago. The sizable current deficit is one of the main reasons for being bearish RON, but in spite of it, the currency is still keeping remarkably stable.

This week will likely pass without any major domestic headlines. We are looking forward to the next NBR meeting (8th November) and the elections (the first round of the presidential election is scheduled for 24th November).

PLN

The zloty remains caught up in global trends. The high-beta currency sold off against most EM and all of its regional peers, succumbing to the dollar’s strength against which it lost 1%. A less solid case for policy easing in the US and an increasingly firmer one in the Eurozone have pressured EUR/USD, and the zloty followed. It is, nevertheless, holding up relatively well against the reference euro so far, remaining in a multi-month sideways trend.

Domestic news was largely ignored by investors. High inflation makes rate cuts a topic for 2025, not 2024. However, recent monthly current account data raised a few eyebrows, with the deficits a slight negative for the PLN in a broader context. This week will provide plenty of readings, with the key one being Tuesday’s retail sales, a chief proxy for consumption. Polish currency, should, however, take cues largely from external signals. Whether EUR/PLN remains in the aforementioned multi-month channel may be tested in the upcoming weeks thanks to the all-important US election. Trump’s odds appear to have improved, which is not great news for the Polish currency.

HUF

A fairly quiet week is behind us, with no domestic macroeconomic data of note released. It was, of course, more volatile, but the forint moved shoulder-to-shoulder with the Czech koruna. Despite further declines in the EUR/USD pair, both ended it with small gains against the common currency.

This week, Tuesday MNB meeting will take center stage. The publication of August wage growth data that precedes it will also be worth watching. Except for July, the headline measure of inflation has been within the MNB’s target range (2-4%) in every month this year, while the core remains slightly above it with fairly favourable momentum (3MAA at around 2.5%).

This leads us to believe that the bank will decide to continue the rate cut cycle, particularly since the reference rate is still very high (6.5%). However, this is not a foregone conclusion, as the battle with inflation is still not won and proinflationary risks are plentiful (the above-mentioned wage growth is among the key ones). Although it’s not our base case scenario, we would not be surprised to see yet another pause; as do most economists, with the majority expecting no change in rates. Tuesday could, therefore, bring heightened volatility. Prior to the decision, we will only receive second-tier readings, thus the behaviour of the forint should be mainly determined by external factors.