Ukraine talks and tariff relief boost European currencies

- întoarce-te

- Latest

The announcement that the US and Russia would hold peace talks over Ukraine boosted European assets last week, and that included European currencies, led by the euro and the Swedish krona.

Business sentiment numbers will be front and center this week, now that tariff fears seem to have at least delayed. The PMIs in the main economic areas will all be released on Friday, and we will look closely at any potential narrowing of the economic performance gap between the US and the Eurozone economies. The UK labour (Tuesday) and inflation reports (Wednesday) for January will add critical information about the UK economy, perhaps the major economic area where the terminal rate is most uncertain.

USD

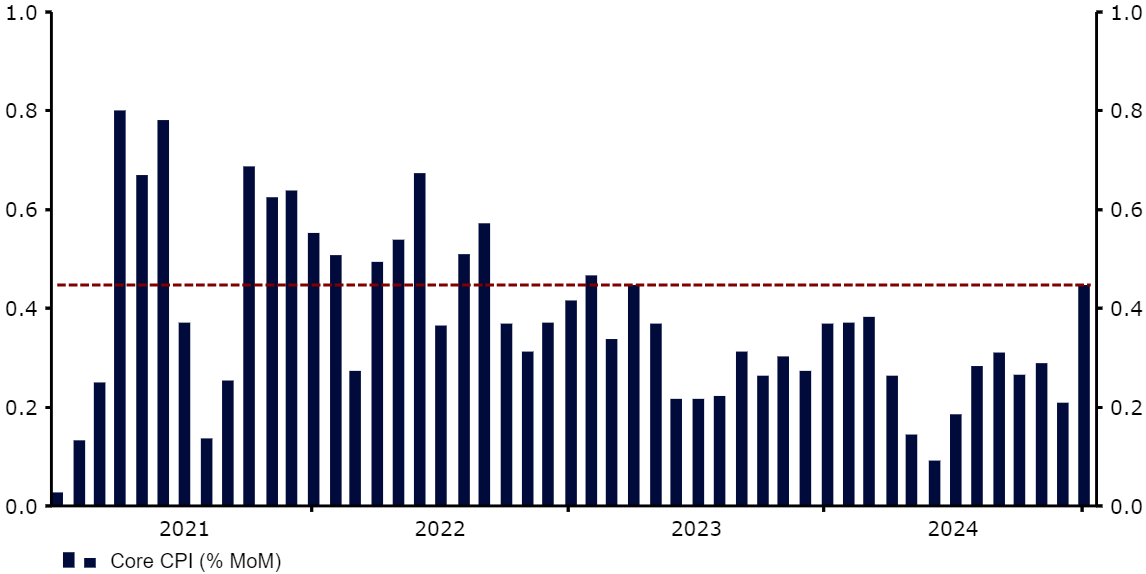

The stability of US Treasury rates last week was remarkable considering the newsflow we have been seeing on inflation. The upward surprise in wages in the January labour report was followed last week by unpleasantly upward surprises in all of the main inflation metrics. A 0.5% month-on-month print in the headline report, which equates to 6% annualised, and a 0.4% monthly jump in the core index (5% annualized) is the last thing that the Federal Reserve wanted to see. We argue that this perhaps brings into question the possibility of any cuts in rates at all in 2025, which is clearly a dollar positive.

For now, the US bond market is taking this news in stride, and the US dollar is trading off of tariff-related headlines, for the most part. With little news of note this week (the PMIs are less market moving in the US than elsewhere), and a holiday-shortened week, the dollar will probably trade mostly off news elsewhere – assuming no further tape bombs from the Trump administration, of course.

Figure 1: US Inflation Rate [% MoM] (2021 – 2025)

Source: LSEG Datastream Date: 17/02/2025

EUR

The apparent delay of any general tariffs aimed at the European Union, for at least a few weeks, was greeted with relief by European assets and the euro. We do note, however, that the threat has only been pushed back in time, and not for very long, so we would be skeptical of any further rally in the common currency unless we start to see some narrowing in the economic performance gap across the Atlantic.

Two timely reports this week could begin to show evidence of such a narrowing. On Tuesday, we get the ZEW survey of investors expectations, followed on Friday by the February flash PMIs of business managers sentiment. Consensus is in favour of a modest uptick in both the services and manufacturing indices, which may alleviate some of the near-term concerns over the state of the Euro Area economy. Growth remains weak, however, and further interest rate reductions from the ECB appear almost nailed on.

GBP

Sterling joined in the general rally against the dollar last week. A positive surprise in the fourth-quarter GDP report, which showed modest 0.1% expansion after economists were bracing for a mild contraction, certainly helped sentiment. We are also perhaps seeing an element of realisation that the February Bank of England meeting was more hawkish than first thought. Speaking last week, MPC member Greene blamed supply constraints, rather than insufficient demand, for sluggish growth, which is a welcome change in our view.

This week will be unusually rich in terms of new information about the UK economy, as labour, inflation and business sentiment reports are all due to be released. By Friday afternoon, we should have a much clearer view of the potential for further policy easing. Megan Greene’s comments, at least, suggest that UK rates may stay higher for longer, and the next cut is now not fully priced in until the bank’s June meeting.

RON

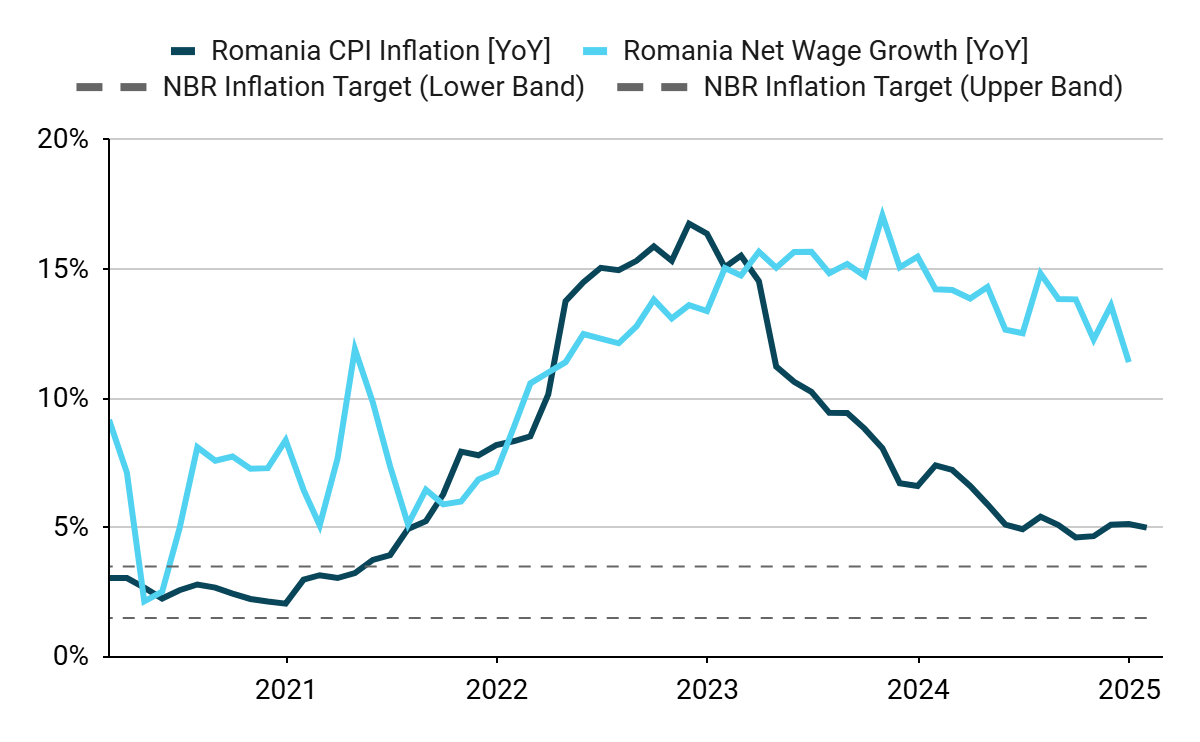

While in the rest of the region, the focus was largely on external factors, the NBR meeting was the main focus of attention in Romania. The main conclusion – interest rates should remain unchanged until the second half of the year at least and even then they are not necessarily guaranteed. Inflation remains resilient, as confirmed by the January reading (5%), and pro-inflationary factors abound, led by still double-digit, albeit dynamically declining (11.4% in December) wage growth.

Figure 2: Romania CPI Inflation & Net Wage Growth [YoY, NSA] (2020 – 2025)

Then again, the Romanian government needs to take immediate action on fiscal tightening, which could bring cuts closer. As could the weaker-than-expected performance of the Romanian economy, which disappointed in Q4, growing by just 0.7% YoY.

HUF

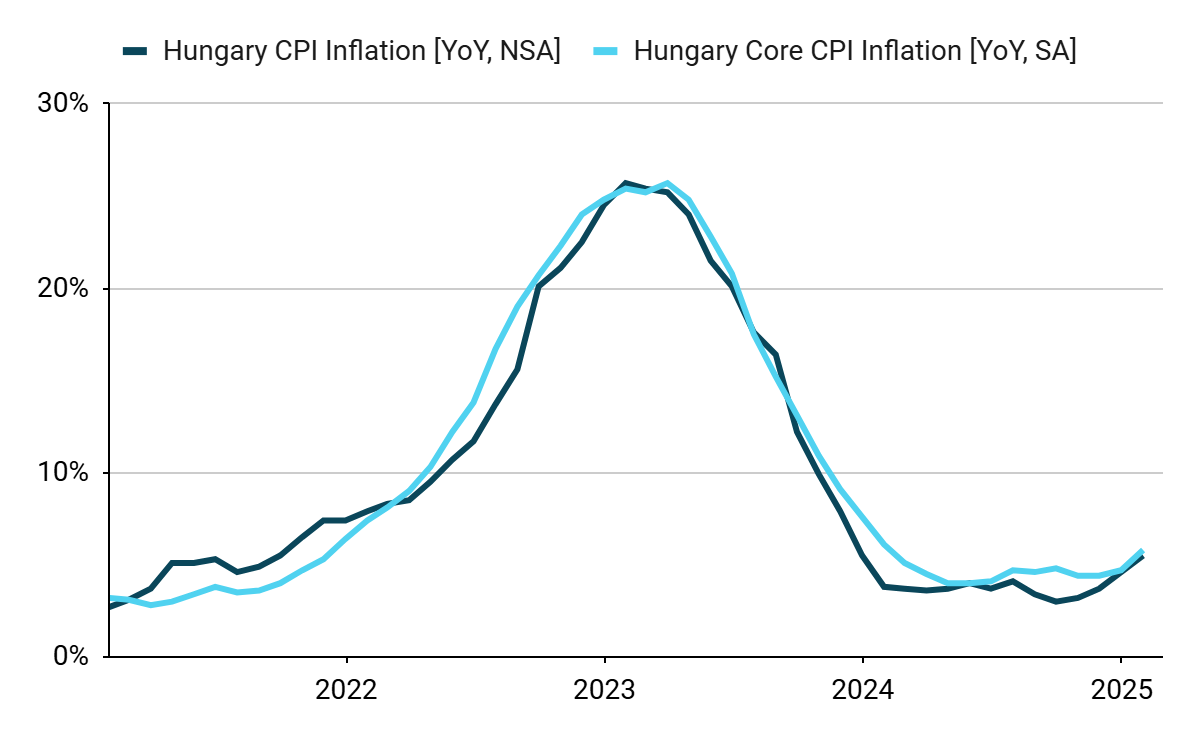

As in other countries in the region, inflation in Hungary placed above expectations in January. Both the headline (5.5%) and the core measure (5.8%, which we find particularly worrying) reached their highest levels in a year. Moreover, pro-inflationary factors abound and tend to indicate that price pressures will remain at elevated levels for longer, significantly pushing back expectations of MNB cuts. Although external factors were key to the forint’s strengthening itself, this data allowed the Hungarian currency to gain slightly more than others in the region (globally, only the Swedish krona and the Chilean peso performed better).

Figure 3: Hungary CPI & Core CPI Inflation [YoY] (2021 – 2025)

Apart from soft economic sentiment readings, there is not much locally awaiting us this week. Attention will mainly be drawn to reports on the Trump-Putin peace talks, particularly as the HUF is the region’s most risk-prone currency.

PLN

The zloty’s rally extended further and actually accelerated last week. EUR/PLN pair reached another low below the 4.16 mark. Zloty is supported by favourable risk sentiment helped by easing tariff concerns as well as rising hopes that the Russia-Ukraine war will stop. The latter feeling has been reinforced by recent signals from the US suggesting urgency to strike a deal with Russia. Considering that recent rhetoric brings more doubts over security partnership with Europe, markets’ cheering may be short-sighted. Further signals over the Russia-Ukraine war and European security are likely to remain important for European currencies, particularly the CEE region.

Turning to economic numbers, it is worth mentioning growth in Q4 (3.2% year-on-year) and inflation, which started the year on unexpectedly strong footing jumping from 4.7% to 5.3%. The latter is likely to cement the NBP’s position that it is too soon to think about rate reductions. This week will bring some more variables important for the central bank, particularly wage growth (Thursday) which is poised for further decline after an unexpected drop into single digits in December.