Relentless US dollar rally continues into 2025

- întoarce-te

- Latest

The holiday period, and the first few trading sessions of 2025, brought no respite for the FX market from the main themes of late-2024.

The new year will kick off with a bang with the release of two key macroeconomic reports. Tuesday we see the release of the December flash inflation report out of the Eurozone, where price pressures have eased, but remain higher than the ECB would like to see. The US labor report for December will then be published on Friday. We will be paying close attention to wage growth data, to see if the uptick of the past few months is maintained. This would make it harder for the Federal Reserve to justify further cuts in interest rates.

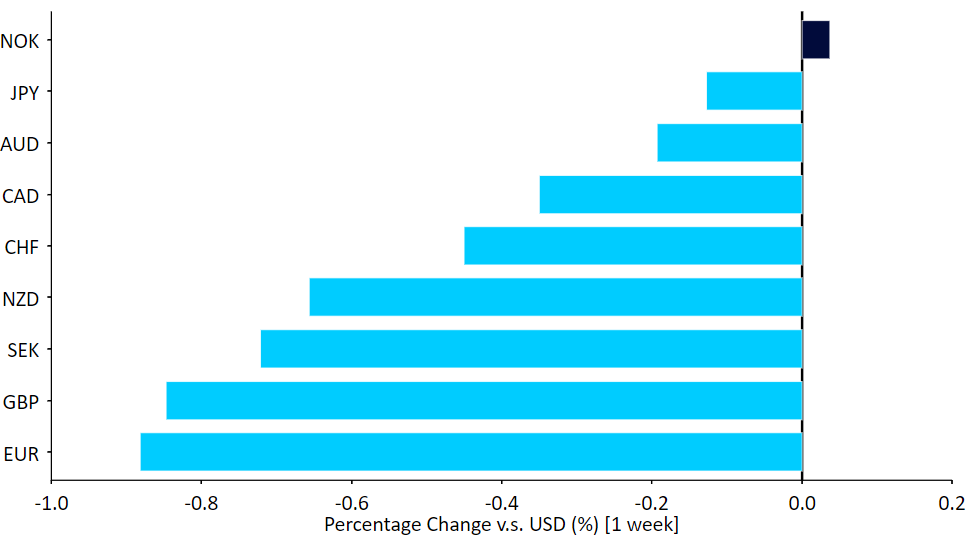

Figure 1: G10 FX Performance Tracker [vs. USD] (1 week)

Source: LSEG Datastream Date: 06/01/2025

USD

The relentless rise in interest rates as prospects for generous Federal Reserve cuts diminish will be tested this Friday by the latest US labour market report. High frequency jobs indicators, such as the weekly jobless benefit claims, show no signs of deterioration, and we expect another month of solid, albeit unspectacular, job creation.

The key number in our view will be the evolution of wages. These have grown for the last few months at a monthly pace of 0.4%, nearly 5% in annualised terms. However, with just one-and-a-half 25bp cuts priced in for all of 2025, a lot of US economic strength, and inflationary pressures, is already in the price of an extremely expensive US dollar. For this reason, we could see a sharp pullback in response to any data disappointment out of the US.

EUR

The common currency continued to lose ground against the dollar over the holiday period. There was little news of note out of the Eurozone, although hawkish noises from Federal Reserve officials, which have voiced concern over stubbornly high inflation, helped drive US rates higher and dragged the dollar along for the ride.

The gap between market expectations for ECB and Fed rate cuts remains wide, and the euro is struggling as a result. Tuesday’s inflation data will be key to gauge the extent to which the ECB can realise the market’s generous expectations for cuts during 2025. Another 25 basis point cut appears effectively set in stone for the bank’s January meeting, although investors will be far more interested in any comments from President Lagarde that could provide clues as to the possible level of the bank’s terminal rates.

Figure 2: EUR/USD (1 year)

Source: LSEG Datastream Date: 06/01/2025

GBP

Sterling tracked the euro very closely throughout the holiday period, in the absence of market-moving news, with the brief move in GBP/USD below the 1.24 level driven almost entirely by dollar strength. The dovish tilt in the Bank of England’s December communique, which unexpectedly showed that three MPC members voted in favour of an immediate interest rate cut, has created a near-term downside risk for the pound. Markets are, however, still taking the view that any policy cuts in 2025 will be gradual, and this has allowed GBP to hold its own against the common currency.

This week looks set to be a relatively quiet one, with only a handful of second-tier data expected. We maintain a constructive outlook on the pound. A decent macroeconomic performance, the likelihood of better relations with the EU under the Labour government and a still very attractive valuation, historically speaking, should continue to support sterling.

RON

The EUR/RON pair ended 2024 with a 0.02% move, indicating a sort of an informal peg, which lasted all throughout the year. Although Romania aims to enter the European Exchange Rate Mechanism II (ERM II) by 2026, the programme does not require such a strict volatility band, indicating that preventing speculation and minimising inflationary pressures serve as a key ground for the informal peg.

The 1st of January marked the first day of Romania’s accession into the Schengen Area. Other than that, the beginning of the year appears rather calm, particularly macro-wise, with November retail sales serving as the only reading of note this week (out on Friday).

PLN

Zloty kicked off the year on a relatively solid footing and strengthened on Monday, helped by an uptick in the major pair. Recent news from Poland, as elsewhere in the area, have been scarce. December inflation showed a smaller increase than expected, to 4.8%. Price growth is expected to rise in the near term before falling and will be closely watched in the coming months, particularly given the recent hawkish shift in communication from the NBP governor. Glapiński’s shift seems a bit out of place but has contributed to the upward repricing of rate expectations (markets now see less than 100bps of rate cuts this year) which is favourable for the Polish currency.

This week will be very quiet in terms of domestic news with outside headlines set to dominate. For now, zloty is holding very well but the environment is filled with risks and uncertainties, many of which are related to the incoming Trump presidency.

HUF

Forint once again proved to be the most prone to global sentiment in the CEE area, weakening by over 1% against the euro over the past week. Domestic macroeconomic data was scarce. Of note, however – manufacturing PMI has broken through the 50 threshold for the first time since May (50.6 in December), with PPI inflation rising to a worrisome 18-month high of 7.9%. Regarding the latter, we have to remember about the low base effect (inflation printed at -6.6% a year ago) which gives additional context into the recent uptick. In other news, the European Commission stripped the country of €1.04 billion in aid (automatic withdrawal two years after the start of suspension), which suggests that over €20 billion, which is still withheld, could well be lost permanently, should Viktor Orban remain reluctant to change his policies.

The next few days will bring hard macroeconomic data for November, namely industrial production and retail sales on Thursday. The Hungarian currency remains under pressure reacting particularly adversely to the rally in the generally strong dollar.