Political earthquake in Romania drives historic RON volatility

- întoarce-te

- Latest

The strong showing of the far-right Simion in the first round of presidential elections and a subsequent government collapse triggered a sharp decline of the leu, which left the informal peg against the euro for the first time in 20 months.

The week ended on a strong footing, with the initial results of the Romanian presidential elections confirming a very strong showing from the far-right candidate, George Simion. Risks for the country have increased, with the outflow of funds exacerbated by Ciolacu’s resignation from the prime minister’s post and the resulting collapse of the government. Thus, for the first time in the history of the CEE Weekly publication, we can report on volatility in the Romanian leu, which will likely end Tuesday with a sell-off of around 2% against the reference euro.

RON

For the first time since September 2023, the EUR/RON pair broke out of the very tight range, posting a 2% increase in a matter of minutes today. We attribute the move to a complex chain of events in the political arena, resulting in a capital outflow from the country. The behaviour of the exchange rate also points to a consequent heavy NBR intervention to stabilise the market, as implicitly confirmed by Dan Suciu, the NBR spokesperson.

It could all be traced back to last year’s presidential elections, cancelled due to allegations of Russian interference and illegal campaign financing favouring the winner of the first round, Călin Georgescu. Since then, the far-right momentum has been on the rise, which found an outlet in a triumphant victory of George Simion in the first round of a presidential re-run.

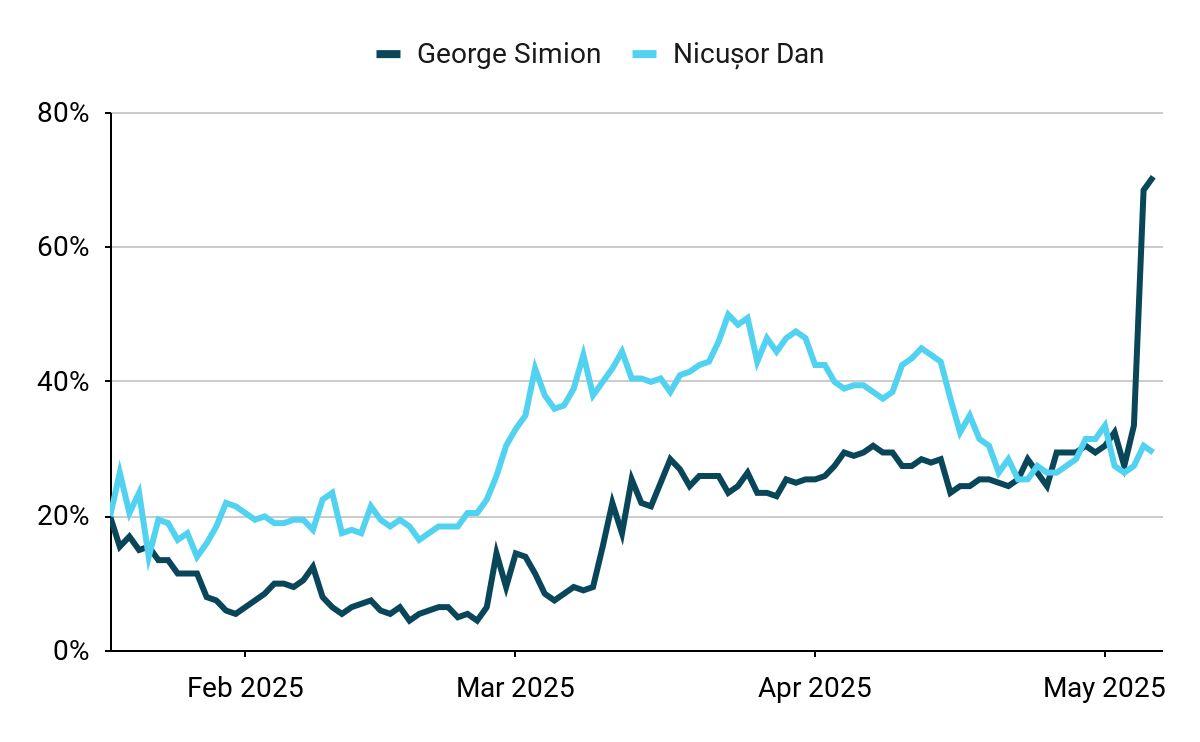

Figure 1: Romanian Presidential Elections Bets (2025)

Source: Bloomberg Date: 06/05/2025

What is surprising is not the victory itself, which was widely expected, but its scale, for the race promised to be a very tight one, with the market attributing almost equal chances of victory to both Simion, Dan and Antonescu. In the end, Simion garnered over 40% of the vote, becoming the clear favourite for the ultimate victory, while the ruling coalition candidate, Antonescu, did not even make it into the second round.

This prompted Marcel Ciolacu to resign from his post as the prime minister – he indicated that in its current form, the coalition no longer has legitimacy. Because of the government’s collapse, parliamentary elections must be held within 45 days. What could be expected is not only a strong showing from the far right, but also the controversial Georgescu’s return to the political mainstream, possibly at the top position in Romania’s political scheme. With Romania already boasting twin deficits and the geopolitical situation in the area tense, this added to the uncertainty about the future economic outlook, with the 10-year bond yields up by over 50 bp. since the beginning of the week.

Sentiment towards Romania is very fragile right now, and scenarios of currency devaluation cannot be overlooked. The leu has found itself in uncharted waters, with the NBR likely needing to remain active to prevent EUR/RON from breaking higher in the near term. The bank is said to have spent over 10 billion euros on interventions in 2024. For the moment, the focus is on the second round of presidential elections (May 18), which could be a pivotal moment for Romania’s future.

PLN

EUR/PLN remains within a narrow range of 4.26–4.29. In recent days, the Polish zloty has underperformed compared to other emerging market currencies, particularly Asian ones. The currency has escaped greater turbulence in the face of sentiment swings in earlier weeks, while at the same time, the improvement in risk sentiment is not providing it much support. This is all the more so given the simultaneous slide in the EUR/USD exchange rate.

Global signals have the potential to shape the situation, particularly for the USD/PLN pair. However, this week is one of the few in recent months when the market will pay such close attention to local developments. This is due to the Monetary Policy Council (MPC) decision on Wednesday (07.05), which is almost certain to bring a significant change in monetary policy.

HUF

Yet another strong showing for the forint, backed by both risk sentiment and the tone of the MNB meeting. Since taking over the governor position, Mihaly Varga, a former Minister of Finance and Orban’s loyalist, rather surprisingly provided us with very consistent hawkish rhetoric, pointing to a heavy accent on the disinflation process, even despite the economic slowdown observed in the country and FIDESZ losing popularity amongst voters.

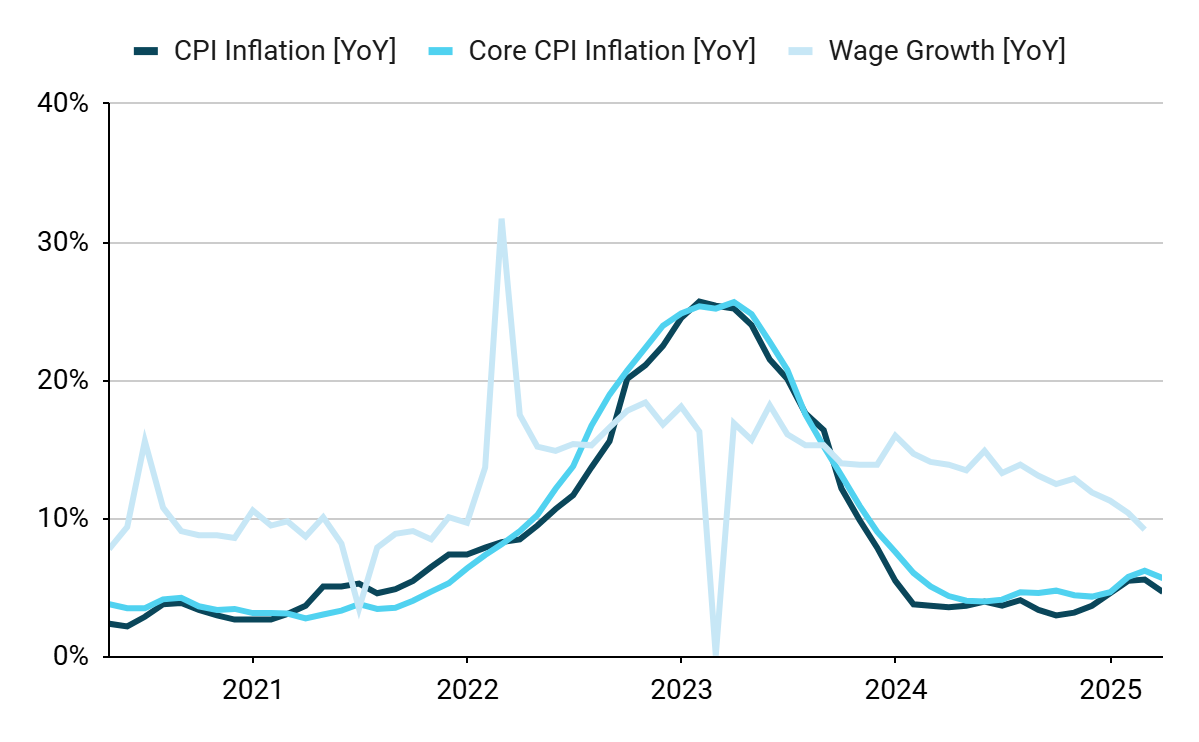

Figure 2: Hungary CPI Inflation & Wage Growth (2020 – 2025)

Source: Bloomberg Date: 06/05/2025

Last week’s meeting proved to be no different, with the MNB deciding on another hold and no signs of loosening any time soon. Although profit margin caps on food and voluntary pricing commitments in the telecom and banking sectors are being implemented to curb price pressures, inflation remains above the upper bound of the MNB’s target. Importantly, the upside risks have increased due to tax measures and stalled global disinflation. Although, as underlined by the MNB, April could have brought a decline in inflation, we foresee it remaining uncomfortably high, which delays the discussion on interest rate cuts to the later part of the year, with an increasing chance of no rate decreases from the MNB in 2025.