European currencies explode as Germany embraces fiscal stimulus

- întoarce-te

- Latest

We saw truly massive shifts in the FX market last week, with moves not seen since the early chaotic days of the COVID-19 pandemic.

Investors are also pricing in a high degree of damage to the US economy from both the substance of Trump’s tariff policies and their amateurish implementation. One of our favoured barometers of US growth, the Atlanta Fed GDPNow estimate, is even pointing to a contraction in excess of 2% annualised in the first quarter of the year. The dollar subsequently lost ground against more or less every currency worldwide, with the US Dollar Index ending the week around 3% lower.

The macroeconomic calendar this week serves up the US inflation report for February. Markets are not really expecting further progress towards the Fed’s target level, with the consensus eying an monthly annualised rate of nearly 4%. However, it is likely that once again macroeconomic information will be overshadowed by the chaos emanating out of the White House, any signs of resulting damage for the US economy, and further announcements of defense spending initiatives out of European countries.

USD

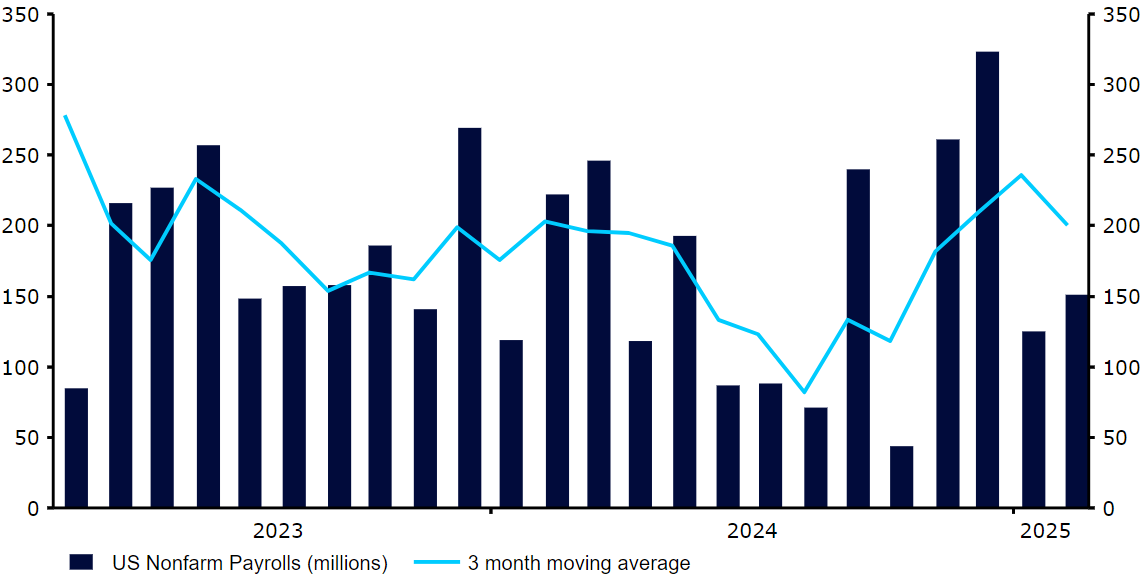

The February payrolls report temporarily calmed fears that the chaos emanating out of the White House will damage US growth, coming in more or less as expected, and still consistent with steady though unspectacular job creation. While this report stabilised the dollar after its dramatic weekly fall, it could not get a rebound going, as US stocks continue to underperform those of the rest of the world in an apparent no confidence vote on Trump’s policies.

Figure 1: US Nonfarm Payrolls (2 years)

Source: LSEG Datastream Date: 10/03/2025

February inflation should be the economic focus this week, but news on tariffs, the war in Ukraine or frankly any other random occurrence in Trump’s social media timeline may well overshadow it. Once again, Trump last week delayed tariffs for Canada and Mexico that fall under USMCA, in another sign that a dilution of the levies is highly likely. This can partly explain the extent of the move lower in the greenback last week.

EUR

The German stimulus package unveiled last week removes the debt brake for most defense spending and launches a 500 billion euro financing vehicle to pay for infrastructure. This “whatever it takes” moment lifted the euro above the 1.08 level, and markets no longer expect the ECB to cut rates below 2%, with a pause at the bank’s next meeting in April now looking like the base case scenario for markets.

Figure 2: EUR/USD (1 year)

Source: LSEG Datastream Date: 10/03/2025

We note that potential negatives for the euro remain. Tariff uncertainty remains significant, and the substantial weakening of American commitment to the defense of Europe cannot be counted as a long-term positive. The sharp move in EUR/USD in the past week has also left it prime for a reversal, particularly should upcoming US data suggest that fears over an imminent contraction in the world’s largest economy are perhaps slightly overdone.

GBP

While sterling also soared against the dollar last week, it lagged a little behind other European currencies, particularly the euro. For now traders like the idea of fiscal stimulus in Germany, whereas the UK is in the process of budget consolidation given its much higher debt. Reports suggesting that Chancellor Reeves will be forced into spending cuts in the Spring will not have gone down well with investors.

Nevertheless, we think that the pound underperformance versus the euro may reverse. The UK economy is relatively less exposed to Trump’s tariffs, as it actually runs a deficit with the US. Further, economic and business newsflow has turned more positive of late, and Bank of England communications remain relatively hawkish, with most MPC members stressing that no more than “gradual” cuts are likely during the remainder of the year. We look forward to monthly GDP numbers on Friday to confirm the trend of slightly better than expected economic news.

RON

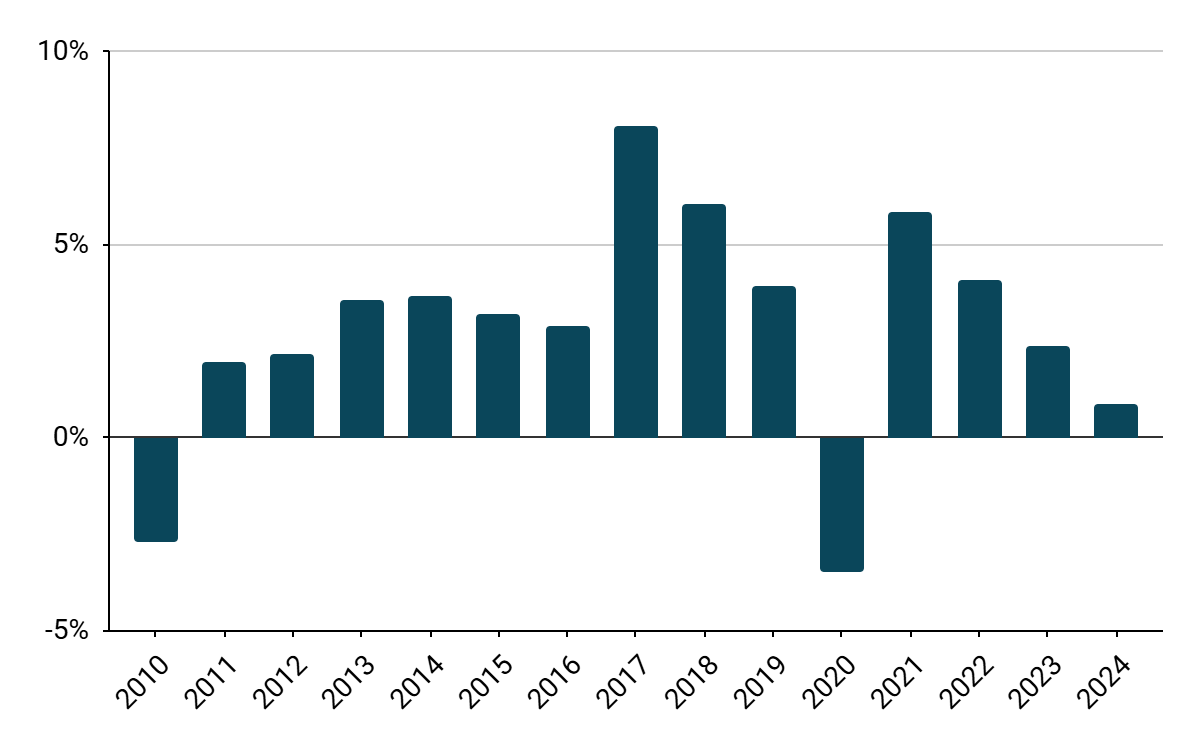

2024 GDP growth turned out to be the slowest since 2010 (excluding the pandemic 2020), at 0.9%. Private consumption has been the main driver of the economy last year (+5.4%), but should weaken in the coming months, more than covered by increased gross capital formation. To some extent, this trend was confirmed by last week’s retail sales figures, which fell to their lowest level in more than a year (3.2%) in January.

Figure 3: Romania Real GDP Growth [Annual, YoY, NSA] (2005 – 2024)

The spotlight, however, was on the issue of Calin Georgescu, winner of the cancelled voting being prevented from contesting in the re-run on 4 May. This is a decision that is all the more courageous and unexpected as it was clearly opposed by the United States and the far-right candidate himself was allegedly the favourite to win. The main reasons behind it are allegations of Russian interference, false statements about campaign financing, involvement with fascist organisations and attempts to undermine the constitutional order. Georgescu still has time to appeal, we should know the final decision of the Constitutional Court by the end of Wednesday, however.

HUF

The forint was not only the best-performing currency in the region last week, but also the second worldwide, just behind the Swedish krona. For the most part, this is a matter of external factors and the HUF’s high susceptibility to volatility.

Locally, we noted the highest retail sales reading in 2.5 years, which has remained around 3-4% YoY for nearly a year, continuously supported by significantly elevated wage growth. Although domestic demand itself should remain an important driver of growth, we expect it to be somehow more sustainable and wide-ranging.

Figure 2: Hungary Real Retail Sales & Industrial Production

The publication of February CPI inflation is scheduled for Tuesday but is likely to recede into the background in the face of a great multitude of events that could influence changes in global sentiment.