Dollar pull back gather speed as tariff threat fades

- întoarce-te

- Latest

A “tariff relief” rally gathered speed last week, as Trump’s flurry of initial activity and executive orders seem to be focused elsewhere for now, and markets hope that their worst fears on tariffs will not be realised.

This week would ordinarily have been dominated by the January meetings of the two most important central banks in the world, the Federal Reserve and the ECB. However, the mercurial Trump administration is liable to steal the spotlight with a sudden tariff decision. We will stick to predicting the predictable and, in this case, there is little doubt about the outcome of both central bank meetings: a cut from the ECB and no change from the Fed.

USD

The holiday shortened week in the US yielded little to change our macroeconomic forecasts in either direction, although a weaker than expected PMI release did help currencies worldwide rally against the dollar. Yet, fears of Trump’s tariffs remain the main driver of currency markets. For now, the onslaught of executive orders has yet to result in any tariff increases, which has calmed nerves somewhat, as has hints of no more than 10% trade duties on China.

This week’s Federal Reserve meeting could be overlooked by market participants. Futures markets are assigning effectively no chance of another rate reduction on Wednesday, and we wholeheartedly agree. For now, we expect the FOMC to adopt a patient approach, as it awaits more details of Trump’s tariff and tax plans before it delivers any concrete guidance.

EUR

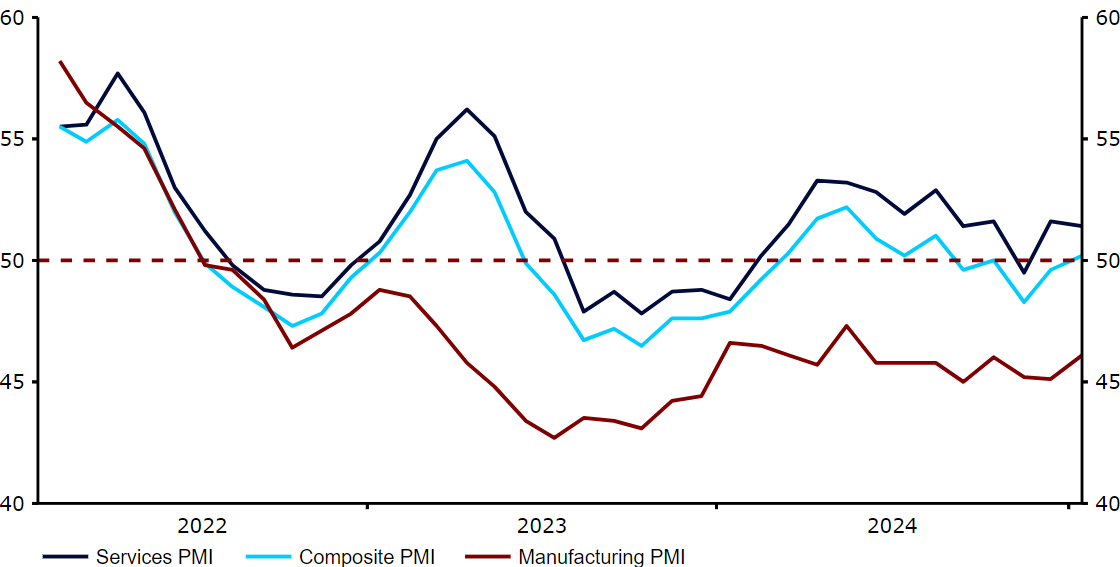

The Eurozone also saw an improvement in the PMIs last week, albeit a more moderate one than in the UK. This was, however, enough to push the composite index just above the 50 level, back to signalling modest levels of growth. The increase was a slight one, but market positioning and consensus for a stronger dollar is so widespread that even the tenderest green shoots in Europe are enough to bring about significant countertrend moves, and the euro is now up for the year against the dollar.

The key for the common currency this week will be the European Central Bank meeting on Thursday. As another rate cut is expected, and fully priced in, we will be paying close attention to the Council’s communications and president Lagarde’s press conference for hints on what ECB members see as a likely terminal level for interest rates in this cutting cycle.

Figure 1: Euro Area PMIs (2022 – 2025)

Source: LSEG Datastream Date: 27/01/2025

GBP

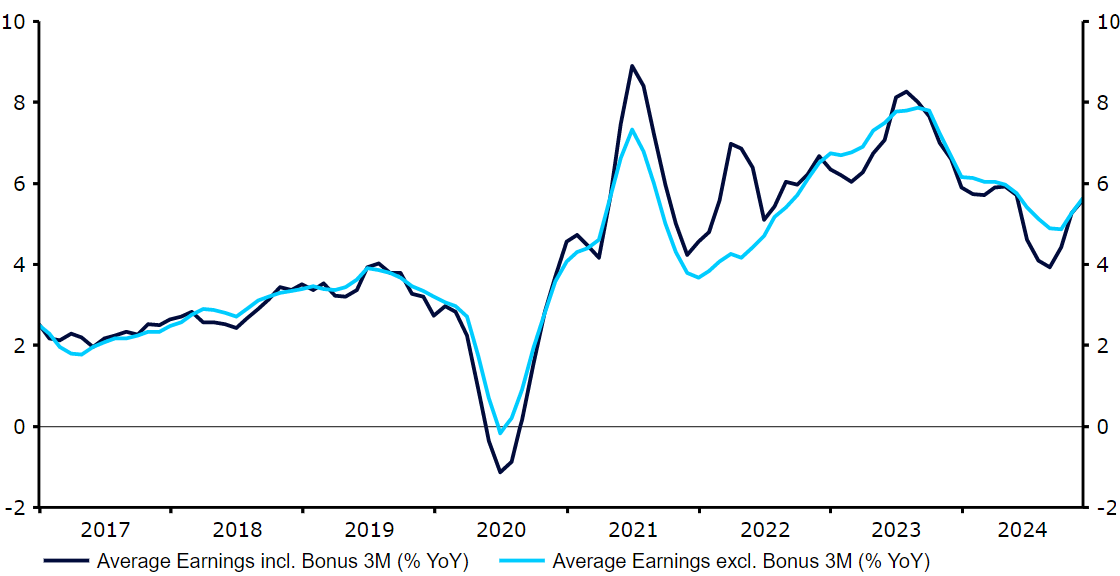

Macroeconomic news flow turned positive for sterling last week. A solid labour report was followed by an encouraging uptick in the PMIs of business activity for January. Both the manufacturing and the services subindices posted gains, and the composite index is now consistent with solid, if unspectacular, growth.

The pound reacted well to the news, posting strong gains against every single G10 currency to end at the top of the currency performance table for the week. An attractive valuation, the prospect of a better relationship with the European Union and relative isolation from the threat of Trump’s tariffs are all significant positives for the pound at these levels. Yet, downside risks remain, most notably the threat of a worsening in labour market conditions following Labour’s employer tax hikes. Indeed, the details of the PMI surveys showed that businesses are now slashing jobs at the fastest pace since the GFC, once the pandemic period is excluded.

Figure 2: UK Wage Growth (2017 – 2024)

Source: LSEG Datastream Date: 27/01/2025

RON

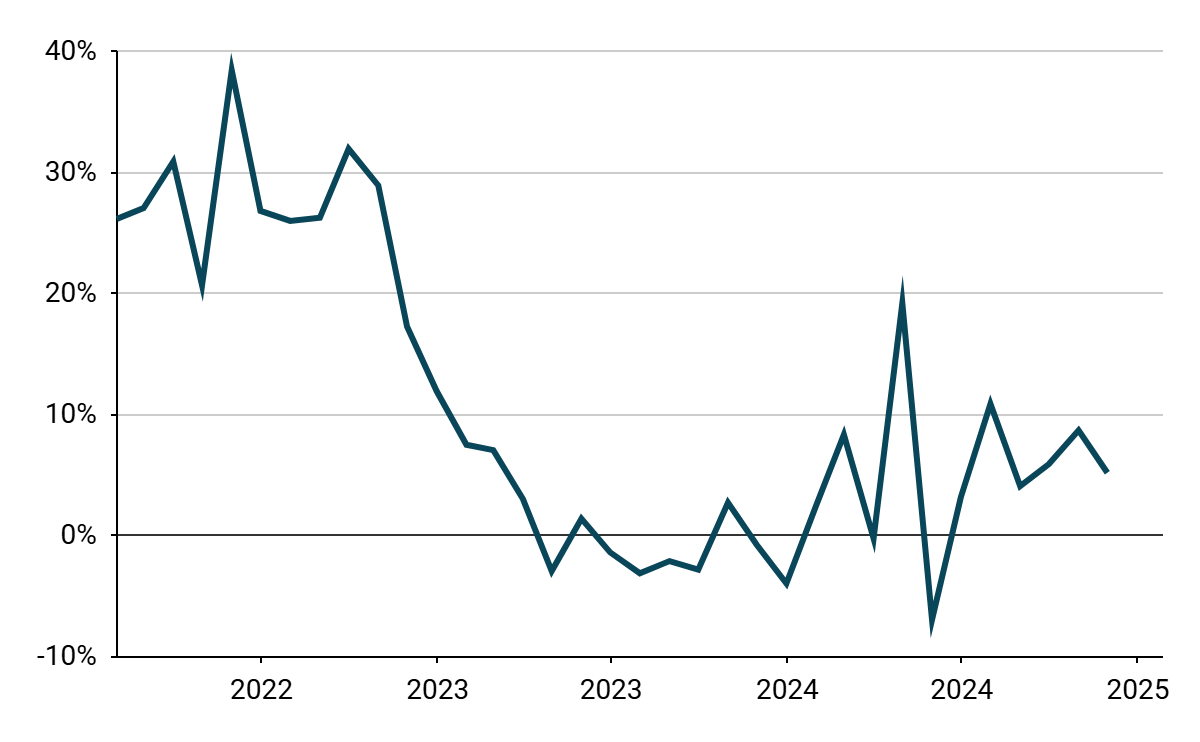

Although industrial production data for November did not impress (a monthly decline, mainly due to the high October base), its growth rate is still impressive compared to other European countries (5.2% YoY in real terms). Hard macroeconomic data points to rather healthy levels of growth, which should be confirmed on Valentine’s Day, the 14th of February.

Figure 3: Romania Industrial Sales (2022 – 2025)

Source: NIS via Bloomberg, 27/01/2025

The same day will see the publication of January CPI inflation and the NBR’s first interest rate decision of the year. In the meantime, we are awaiting December retail sales (06/02) and wage growth (13/02) data. This week, however, is set to be relatively dull, at least data-wise, thus the focus will once again shift to the US.

HUF

Forint performed relatively well due to the aforementioned risk-on following scarce US tariff information. Soft local data disappointed, with consumer and business confidence, as well as economic sentiment all declining and remaining at or near multi-year lows. This does not seem all too surprising, considering the rather bleak macroeconomic performance in the last few months, as well as the continued political turmoil, which further decreases the chances of the country unblocking more than EUR 24 billion of frozen funds and grants from the NIP and the Cohesion Fund.

PLN

Last week was a historic one for the Polish zloty with the currency reaching the strongest position in 5 years against the euro following an over 1% rally. EUR/PLN is now very close to a psychological 4.20 level and everyone in the markets is anxious to see if it descends further and breaches that level. Aside from the factors supporting other CEE currencies mentioned above, it is worth noting that interest rates in Poland remain rather high at 5.75% and the hawkish tone of NBP governor Glapiński’s recent comments suggest we will likely have to wait for cuts a bit longer than thought a few months ago.

Markets have clearly been in better spirits of late and an extension of the rally in the zloty in the near term cannot be entirely ruled out if encouraging newsflow continues although given the scale of the rally, profit-taking seems more intuitive. At the same time, on a valuation basis, the currency looks far from cheap – and Poland’s real effective exchange rate recently reached its highest level since 2008, registering an increase to the tune of 20% in the last 2.5 years. The EUR/PLN move also slowed significantly toward the end of the week even with the broader market catching up.

It is also worth noting that last week’s data releases from Poland were overall quite weak, pointing to a decreased risk of persistent inflation. In this context it is particularly worth mentioning that wage growth was surprisingly slow, falling to single digits (9.8%) for the first time in a year. Retail sales also surprised significantly to the downside and while they’re becoming increasingly less of a great proxy for consumption they support the argument that consumption is not booming. On tap for this week is the 2024 full-year GDP reading (Thursday). While important, zloty is likely to react more to outside signals.