No rush to cut: Fed’s hawkish message gives the dollar a boost

- întoarce-te

- Latest

The Federal Reserve threw the dollar a bone last week, as it held policy steady and warned that it would not be in a hurry to lower interest rates at upcoming meetings.

In the UK, the Bank of England held rates steady last week, while delivering a mild hawkish twist to its communications. The Swiss National Bank, meanwhile, lowered its policy rate by another 25 basis points, in what looks highly likely to be the final cut in the current cycle. With the exception of upcoming tariff developments, markets will this week be focusing on the G3 PMI figures (Monday), UK inflation data (Wednesday) and the Fed’s preferred metric of US inflation (the PCE index) on Friday.

USD

The dollar clawed back some ground against its major counterparts last week, buoyed by a hawkish Fed and some broadly upbeat US data. As expected, the Federal Reserve held rates steady on Wednesday, while also issuing a rather sharp downgrade to its growth projections for the next three years. Yet, the FOMC appears increasingly fearful of inflationary risks, and the “dot plot” of interest rate projections suggests that officials still see just two 25 basis points rate cuts this year – as they did in December.

The main fear for investors of late has been that Trump’s unpredictable tariff proclamations would send the US economy careering into a sharp and disorderly downturn. Thus far, at least, this has not been overtly evident in the data, with reports on the labour and housing markets surprising to the upside last week. We’ll receive the preliminary PMI figures for March later today, which could go a long way in easing the market’s recession jitters. Focus will, however, be almost squarely on the unveiling of next week’s reciprocal tariffs, which bodes to be the next major event risk for financial markets.

Figure 1: FOMC Dot Plot [March 2025]

Source: LSEG Datastream Date: 24/03/2025

EUR

Optimism surrounding the unveiling of Germany’s massive fiscal stimulus measures has propelled the euro to near the top of the month-to-date G10 FX performance tracker. We’ve seen a mild retracement in the common currency in the past few trading sessions, however. While Germany’s historic plans passed a key hurdle in parliament last week, it remains to be seen whether the measures will provide a meaningful boost to Euro Area growth, particularly given that most other countries in the bloc have limited room to follow suit.

This morning’s S&P PMI numbers for March will now be a key test for the euro. It will be interesting to see whether the news out of Germany is reflected in stronger sentiment among business owners, or whether the more immediate threat of US tariffs is seen as weighing on activity. Another downside surprise here could conceivably cement the case for another rate cut from the ECB in April, which is already almost 70% priced in by swaps.

GBP

As expected, the Bank of England held rates steady last week, although it delivered a mild hawkish twist in its communications. Right off the bat, the 8-1 vote was more empathic than anticipated (7-2), with Catherine Mann (who favoured a 50bp cut last time out) rejoining the hawks. Policymakers warned over the downside risks posed by President Trump’s tariffs, although they also upgraded their Q1 GDP estimate and said that UK inflation would rise higher this year than had been previously anticipated. All in all, the communications are consistent with our view for just two 25bp cuts during the rest of 2025.

Focus now quickly turns from monetary to fiscal policy, with the Labour Party set to unveil its Spring Statement on Wednesday. With the OBR’s UK growth forecast set to be slashed to bits, and the government’s fiscal headroom seemingly severely eroded, additional spending cuts on top of those reported last week appear highly likely. We are not expecting any news of further tax hikes this week, although we wouldn’t be shocked if Chancellor Reeves lays the foundations for such a strategy in the Autumn.

RON

The first week of the new Romanian government is behind us. The coalition is almost unchanged as compared to the last one – the centre-left PSD and the centre-right PNL have been joined by the UDMR, representing the ethnic Hungarian minority. Numerous challenges lie ahead, with debt reduction appearing both critical and the most daunting. The government largely created this hurdle itself, having engaged in an excessive spending spree late in its previous term, marked by unfunded pension hikes, public sector wage increases, and social transfers. Estimates put the 2024 budget deficit at over 8.5%, with limited scope for immediate spending cuts. Moreover, persistently high inflation and constrained growth further narrow the government’s options.

The Constitutional Court’s decision to disqualify ultranationalist Călin Georgescu from the rerun presidential election has not gone unnoticed either, remaining a hot topic in the media. Some view it as mitigating a significant political risk—namely, the rise of a candidate with at least questionable ties to Russia. However, not all institutions view this turmoil as favourably: last week, Moody’s downgraded Romania’s sovereign rating outlook from “stable” to “negative,” while affirming its Baa3 rating, the lowest investment-grade tier.

HUF

For the first time in 12 years, the National Bank of Hungary (MNB) will convene without György Matolcsy at the helm. His successor is Mihály Varga, a former Minister of Finance and Economy. Varga, although a Fidesz party member and an Orbán loyalist, is recognised for his economic pragmatism, which could suggest a balancing act between populist fiscal policies and a more disciplined monetary layer.

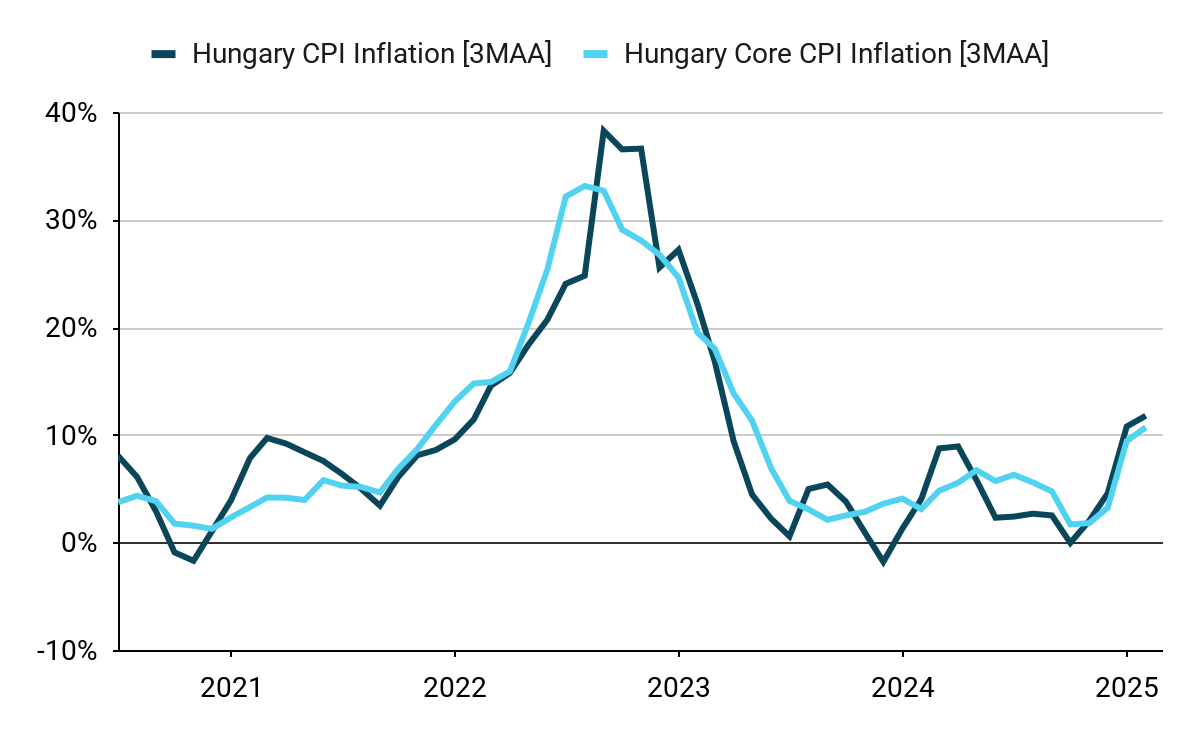

Figure 2: Hungary CPI & Core CPI Inflation [3MAA, NSA] (2020 – 2025)

Confirmation of this hypothesis will require some patience, as Tuesday’s decision is unlikely to pose a dilemma for the bank’s policymakers. Inflation remains significantly above expectations, with its current momentum pointing to double-digit levels on a 3-month annualised average (3MAA). We thus anticipate not only a pause but also rather hawkish guidance.